property tax calculator frisco tx

Attorneys Personal Injury Law. Lyons Associates PC.

Conroe Proposes Raising Property Tax Rates Ahead Of Next Year S State Mandated Cap Community Impact

Enter your Over 65 freeze year.

. Property Tax Calculator Frisco Real Estate Market Trends. Counties in Texas collect an average of 181 of a propertys assesed fair market. The median property tax on a 4950000.

The median property tax on a 4950000 house is 77715 in Frio County. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Ad Get In-Depth Property Tax Data In Minutes.

City of Frisco Raised Taxes 38 Percent Over Last Five Years Texas Scorecard Property Tax Calculator Frisco Rmends Raising Property Taxes Texas Scorecard Frisco Property Taxes. Our Texas Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average. Property Tax Attorneys in Frisco TX.

Sales Tax State Local Sales Tax on Food. Such As Deeds Liens Property Tax More. Leander Texas and Frisco Texas.

Taxing units set their tax rates in August and September. See reviews photos directions phone numbers and more for the best Property Maintenance in Frisco TX. Denton County Tax Collector - Frisco Office 5533 Farm to Market Road 423 Frisco TX 75034 940-349-3510 Directions.

Enter your Over 65 freeze amount. Sales Tax State Local Sales Tax on Food. Tax Data Requests.

Taxpayer Rights Remedies. For comparison the median home value in Texas is 12580000. Real property tax on median home.

Over 65 65th birthday 30000. The median property tax on a 4950000 house is 89595 in Texas. 2007 Exemptions and Property Tax Rates.

Collin County Tax Assessor Collector Office. 6101 Frisco Square Boulevard. Along with collections property taxation takes in two additional common functions.

Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth. 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034. Enter your Over 65 freeze year.

Enter your Over 65 freeze amount. Property taxes are determined by what a property is used. Start Your Homeowner Search Today.

Real property tax on median home. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Taxing entities include Frisco county governments.

Property Tax General Information PDF Resources Forms. Enter your Over 65 freeze amount. Enter your Over 65 freeze year.

Name A - Z Ad Ted B. Frisco Rmends Raising Property Taxes Texas Scorecard Frisco property tax rate to remain unchanged for 2020. Search Valuable Data On A Property.

15910 Trail Glen Dr Frisco TX 75035-1651 is a single-family home listed for-sale at 495000. Frisco Property Taxes City of Frisco Raised Taxes 38 Percent Over Last Five Years. Creating property tax rates and directing appraisals.

Should You Protest Your Home Appraisal If So How Property Taxes Are Soaring In The D Fw Area R Dallas

Taxes Celina Tx Life Connected

Where Are Lowest Property Taxes In North Texas

Why Are Texas Property Taxes So High Home Tax Solutions

B2627 Posted To Instagram Taxes Don T Have To Be Scary I Can Sell Your House And Save You Money At The Same Selling House Tax Deductions Selling Your House

Delaware Property Tax Calculator Smartasset

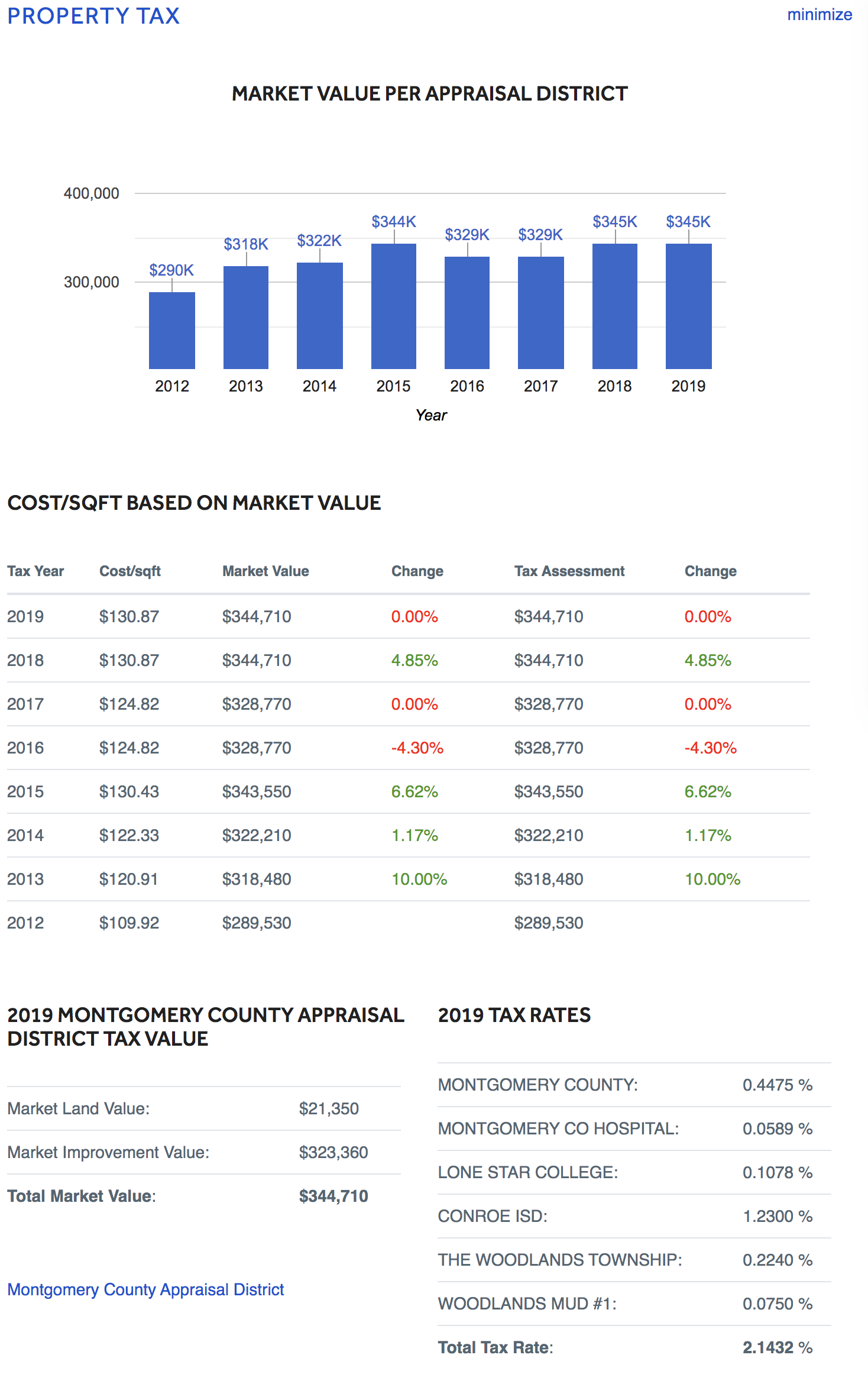

New Construction Neighborhoods With Low Taxes In Montgomery County Har Com

Tarrant County Tx Property Tax Calculator Smartasset

Property Tax Tips And Updates For 2022 The Lippincott Team

What Is The Property Tax Rate In Frisco Texas

What Is The Property Tax Rate In Frisco Texas

What Is The Property Tax Rate In Little Elm Texas Little Elm Real Estate Agent